Day Trader Steve — Market Flow Newsletter No. 03

[Altcoins Beat Up Again? One month post-Oct 10th]

Intro & Last Edition Recap:

There is a huge amount of data to unpack from the past 30 days, so let’s get into it. Last update we focused on a potential blow off top for $GOLD (now confirmed), we looked at market structure for $BTC, $ETH, $BNB, and I talked about their key resistance levels. It’s been two weeks since that issue, and nearly 30 days since the October 10th market-wide manipulation event that wiped out ~$20B from Crypto markets.

For a quick $BTC refresher, on last issue I noted, “Next up is $117k, minor horizontal resistance, but still expecting some volatility around there.” & boy did we get volatility. Not even I saw the nuke to $98,000 coming. In hindsight it’s very clear on the charts, as you’ll see below:

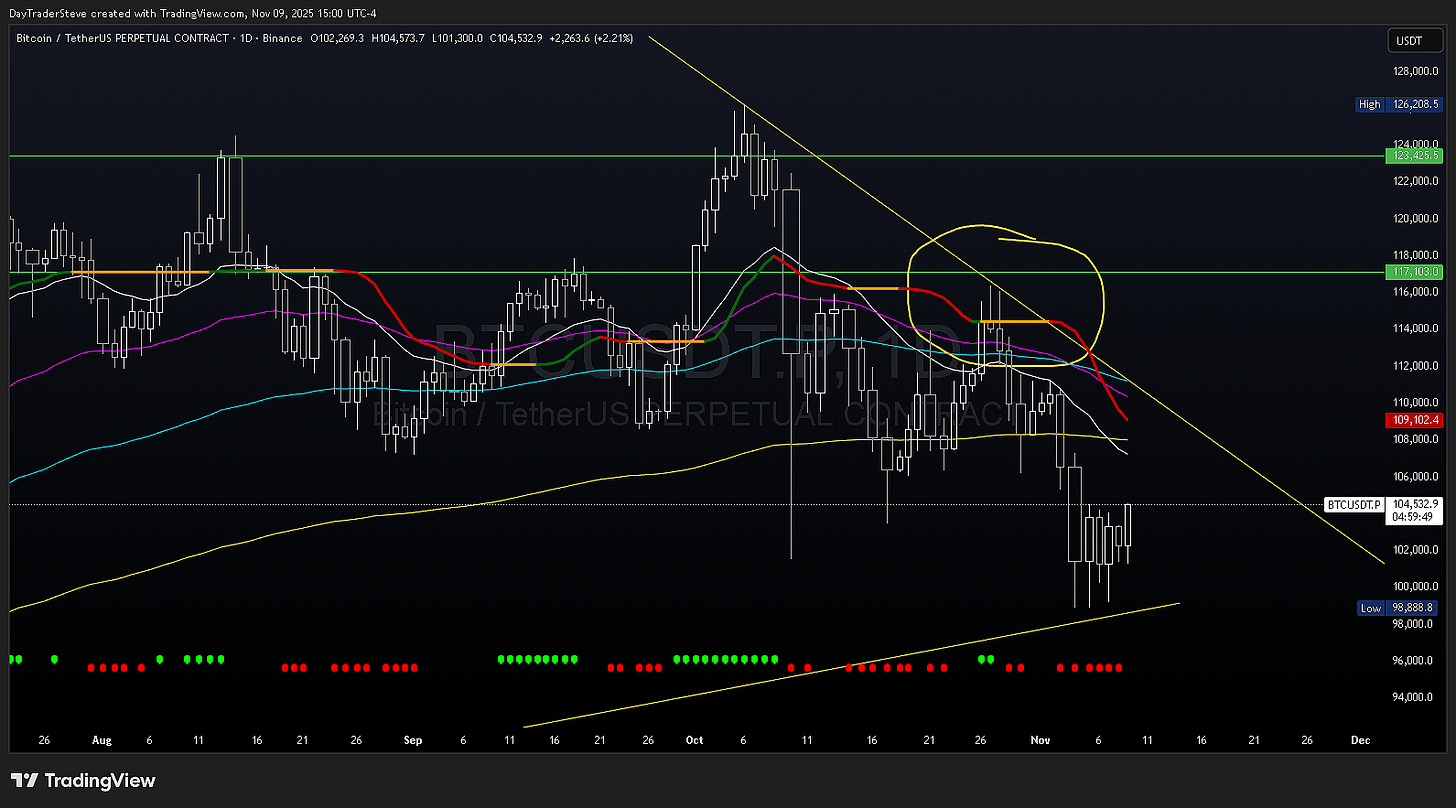

$BTC DAILY CHART:

On October 27th we poked the $117k resistance level (green horizontal), as well as the descending Yellow Trendline, then two Daily topping tails formed, and we closed under our Alpha Trendline. There was a small bounce off the 200D EMA (Yellow) into the 20D EMA (White), which very quickly rejected again. Over the following 8 days we saw $BTC fall and retest the CRITICAL $100k support zone, falling -15% — which is holding up, for now.

Could this be the local bottom on Bitcoin? My bias leans towards yes, especially since Trump just announced a fresh round of ‘stimmies. But from a purely technical perspective, we’ve witnessed a death cross on our Daily EMA stack > 20 EMA now sits below 200 EMA. Which means at MINIMUM, we need to reclaim the $108k level to feel even remotely safe that we aren’t heading lower.

Day trading is great here to capture intraday volatility, but I would NOT be buying a “set it and forget it” Bitcoin allocation here. Way too much downside risk.

Now on to Alts, last issue we plotted Alt strength / resistance levels for $ETH and $BNB. You’ll recall that I said regarding $ETH, “The first brick wall is the descending Yellow trendline sitting around $4,300.”

We didn’t quite get there. In fact, at $4,250 we fell through the floor. This was expected, while I didn’t quite see $BTC falling back to retest $100k, we knew Alts would be weak while $BTC failed to sustain it’s All Time Highs. $ETH subsequently fell -30% from my last issue, which would have been a beautiful short trade for any of you who followed.

$ETH DAILY CHART:

You can see we’re now at real risk of the Daily chart rejecting its 200D EMA. If this happens, it’s game over for $ETH for a while. It we reject here around $3,600 — you bring into reality several key prices, firstly $2,200 and then $1,500 if that doesn’t hold up. I don’t think I have to tell you what happens to the rest of Alts if $ETH shits the bed here. It NEEDS to reclaim its EMAs for any hope of higher or Alt season.

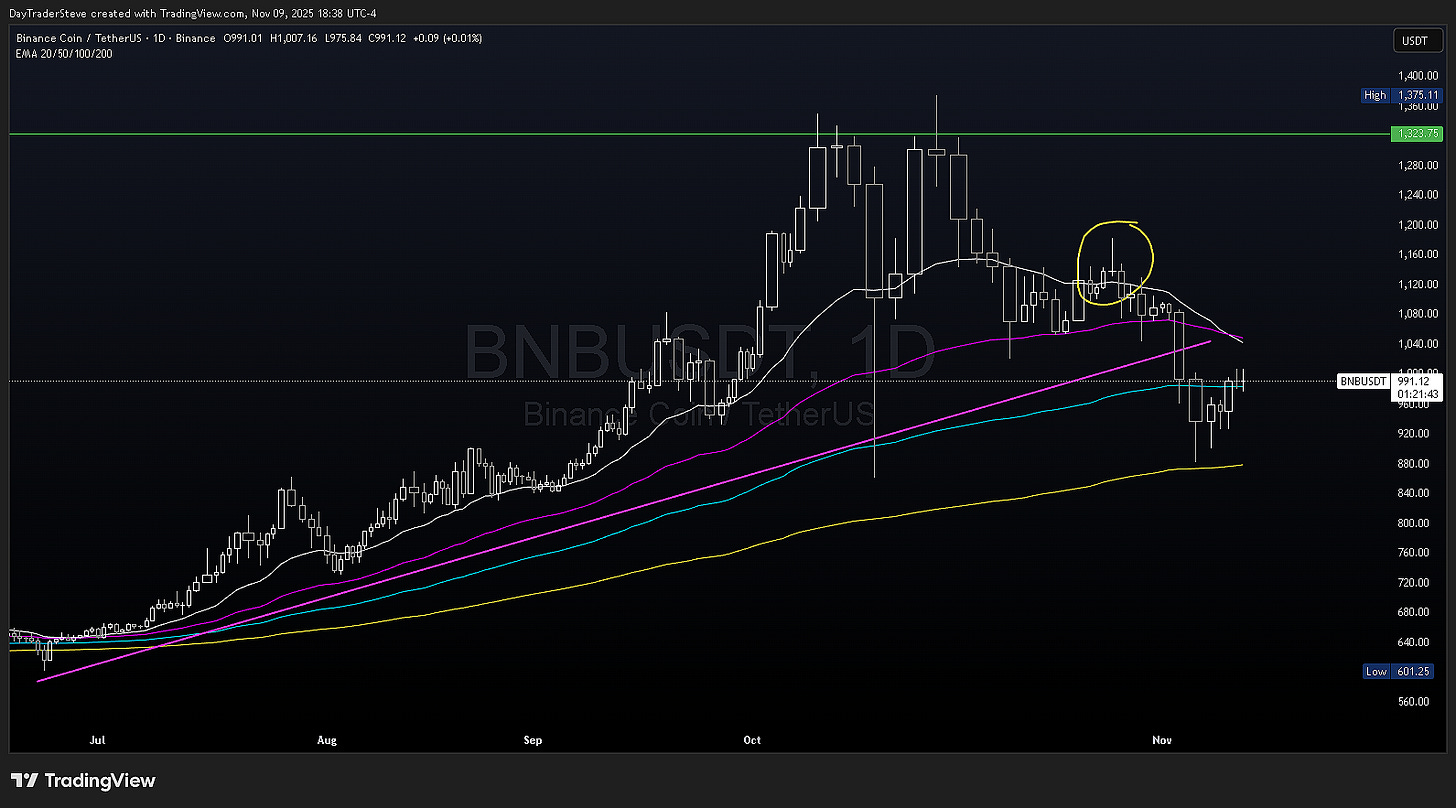

Which brings up $BNB, last issue I noted, “$BNB broke $1,000 for the first time this year as one of the strongest Alts. [It’s accepted the $1,000 price level (for now)], If today closes with a steep upper wick like we are currently seeing (10:52 EST) it would be a bad sign. If we close under the trendline ($1,115) it reopens the possibility for $BNB to move lower”

$BNB DAILY CHART:

That topping tail turned out to be a very clear omen, as we nuked -25% over the following 8 days. $BNB now sits below its psychological $1,000 number — the good news is it seems to have bounced off its 200D EMA, but I don’t trust this until we reclaim $1,000. It has huge significance now.

You can see how irrelevant trendlines are also, note the ascending Pink Trendline, price did not respect it AT ALL. It blew straight through it with zero hesitation. So while it’s useful to draw trendlines to visualize potential support / resistance zones, they don’t represent anything meaningful from a purely technical perspective.

So now what?

I mentioned Trump just announced fresh Tariff ‘stimmies. He’s trying to launch another round of stimulus checks on the back of his “Tariff Profits.” Essentially every US Citizen would received a few thousand bucks, this represents hundreds of Billions worth of liquidity, and if it hit’s the equity / crypto markets… things could go vertical quickly.

We saw this movie in 2020 already. Huge pandemic, economic crises, money printing, end of QT, start of QE, stimulus checks. Had you bought virtually any Cryptocurrency between March-May of 2020 you’d have made a killing. $800B+ in stimulus checks went out, and Bitcoin rose nearly +800% over the following year.

Am I saying we’re about to go vertical for the next year straight? No. But the current global macro-economic state of affairs REEKS of 2020.

What does my portfolio look like?

Well for one thing, I’m a Day Trader, so I carry a lot of weight in USDT (stables). I need dry gun powder at all times. That’s because I trade intraday swings, it’s how I extract USD value from the market on a daily basis, using my customized VWAP system. It means I don’t usually care what the ticker is, I care whether the price action meets my trigger system. Is it firing on my indicator alerts? Do I have 6/8 “triggers” going my way? I want high probability trades, not 50/50 guesses.

This strategy is for a very select few individuals. You need to meet the following criteria: losing money doesn’t bother you, you can handle far greater stress-loads than the average human, you are determined and driven to escape the grind, no matter the cost, and you possess a non-human level of discipline. Day Trading will annihilate your portfolio if you don’t have expert level comprehension of technical trading fundamentals.

Now speaking long term investing, Alts in general mean little or nothing to me. If it’s not Bitcoin I generally don’t GAF about it. But that doesn’t mean I don’t trade Alts, in fact, 90% of my Day Trades are on Alts like ETH, TAO, DOGE, FET, to name a few. This is because they are extremely volatile, and offer sizeable returns day to day for those who can interpret signals correctly. But the vast majority of plebs (ordinary people) should probably just convert their entire 401k / RRSP into $BTC and never look at it again. If you have 5-10 years before your retirement, that’s what I’d be doing. I would stick every single fucking dollar of my savings into Bitcoin alone. You just cannot comprehend how much Institutional & Gov’t money has flooded into this asset. If you don’t accumulate Bitcoin now, you’re essentially betting AGAINST Wall Street. People who make those bets lose every single time.

So, other than being nearly 80-90% in Bitcoin long term, I have made a few asymmetric bets on projects which I believe will outperform. They are Ethereum, Bittensor (TAO), Artificial Superintelligence Alliance (ASI or FET), and Dimitra (DMTR). In a sea of thousands of tokens, you are far better off deeply researching a select few and betting big on them. If you sprinkle holdings into dozens or even hundreds of tokens, sure you might win a few gambles on a 100x, but unless you have meaningful size allocated to it, it won’t yield life changing money.

As always, Trade Smart and Reduce Your Risk!

—DTS.