Day Trader Steve — Market Flow Newsletter No. 01

[DeFi's Worst Mass-Liquidation Event In History]

Welcome to my maiden Newsletter. It’s been a long time coming, and I’m glad to have finally found the discipline (and catalyst) to begin publishing. Those of you who know me personally know I’ve been writing privately for nearly 20 years. I’ve built up a micro-following on X by sharing my Crypto-focused trading analysis over the past 5 years, and after the event we witnessed on October 10th, it’s time to get serious about helping a larger audience navigate these extremely complex markets.

The ramifications of the October 10th market-wide nuke are so unbelievably toxic for DeFi, it honestly saddens me deeply. But it also informs me of how early to this industry we all still are. Which is the exact reason to pay attention and start developing your macro skills — because we are still at an early stage in a nascent industry where there is maximum opportunity. This WILL NOT always be the case.

It disgusts me on a moral level knowing how many millions of Traders were liquidated and farmed by CEXs during the world’s largest single-day liquidation event. That damage is irreparable for the vast majority of retail Traders who don’t have access to unlimited capital. So let’s dig in to the “Why” of how this event happened in the first place.

What Happened — In Plain English:

Between 10am–6pm EST on Oct 10th, Crypto was annihilated:

• BTC dumped -10% from ~$122k toward ~$102k

• ETH dumped –20% poking its 200D EMA at $3,500, and major Alts cratered!

Double-digit slides everywhere; some mid/small caps lost up to ~80% or more of their value in hours. This is not natural or organic price action, to be sure. Is it manipulation? I don’t have any concrete data, but it sure as hell cannot be considered “fair market” pricing.

Total liquidations amounted to $19–20B; which is exponentially worse than the $LUNA collapse (<$1B), the FTX collapse (<$5B), and the COVID collapse (<$5B) —because the cascade was faster and the market was more levered. Meaning, the Alt market specifically was propped up on borrowed money and exchange leverage, not spot demand.

The Immediate catalyst? Trump’s “100% tariffs on China” post [on a Friday no less.]

So was this “Just” the Tariff Headline?

Or Was It Inevitable?

The short answer is actually both. The tariff headline was the spark; the tinder was already stacked, and written in the charts for days leading up to it.

Pre-crash tells:

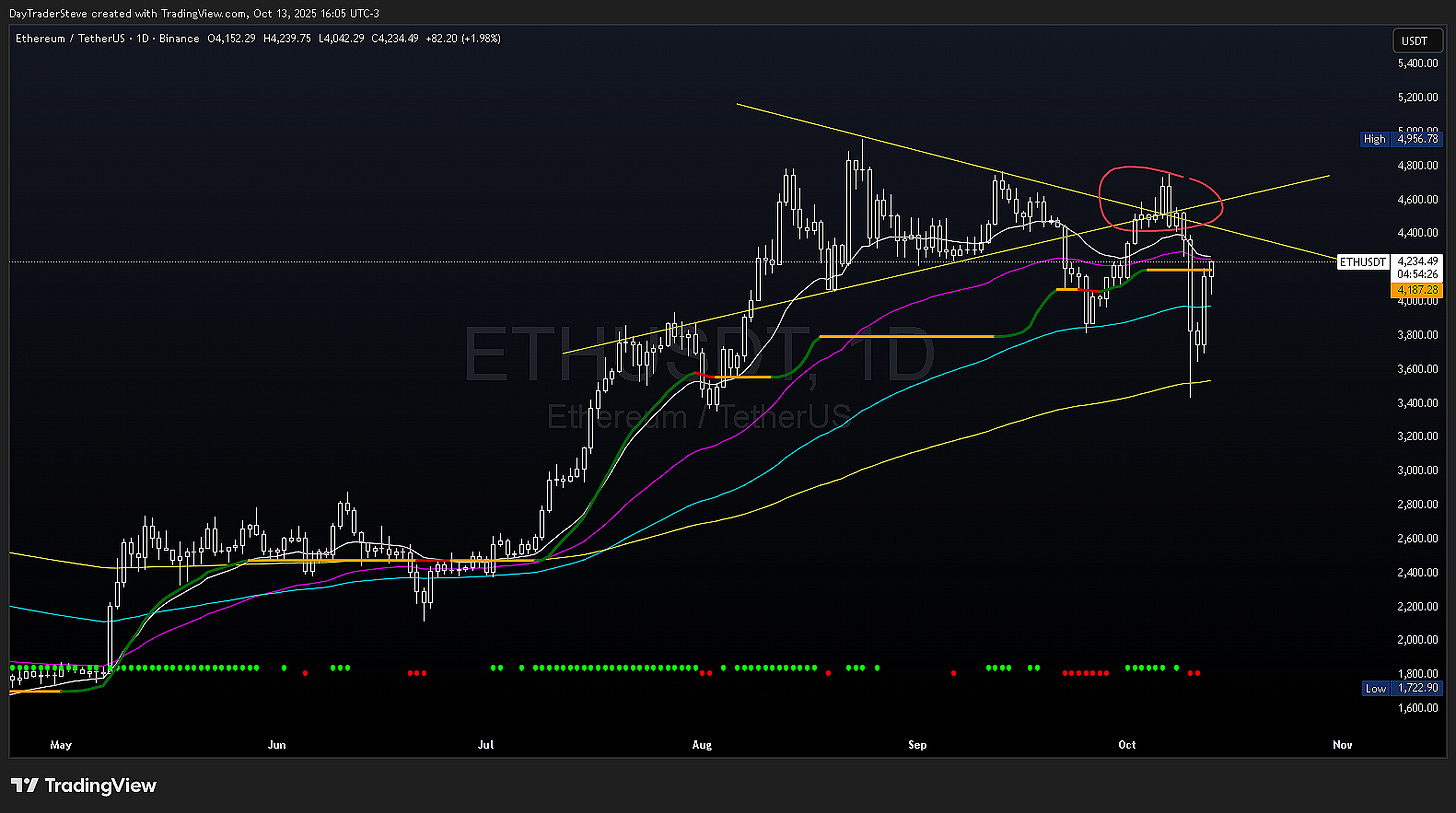

Overextension: $BTC had just printed a new ATH and was failing to breakout or turn the $125k level into support; several Alts were stalling at resistance. $ETH had just printed a Daily fake-out at a major resistance level.

Below: $BTC failed ATH push

Below: $ETH fake-out pattern

Structures deteriorating: H&S-style tops, lower highs, and failed breakouts across major Alts.

Sentiment was frothy → fear: Greed readings flipped to fear overnight.

Leverage stretched: OI heavy; funding not insane everywhere, but risk crowded into Alts.

Breadth was weak: Fewer alts making higher lows; more names leaking below 4h 200EMA—my “uh-oh” zone.

When the headline hit this caused forced “risk-off” selling, then thin order books did the rest.

The Whale Story (Why Everyone’s Furious)

On-chain sleuthing points to a brand-new Hyperliquid account (tied by some analysts to an old BTC “OG” wallet) that:

Loaded massive BTC/ETH shorts in the days leading up to and the final 30 minutes before the tariff announcement (≈ $1.1B notional).

Closed most shorts near the bottom for ~$190–200M in profit.

Then flip-traded around the cascade, and reportedly positioned for the bounce.

Is that insider trading? It’s definitely foreknowledge (at best). Direct proof of illegal coordination hasn’t been presented publicly. But the timing is too perfect for most people to call it luck. At minimum, one or more whales front-ran the move and extracted nine-figures while the crowd got rinsed. This suggests close ties to Gov’t, or insider info being shared. This is no different than insider trading by politicians — which happens en masse, and is seldom penalized. Why would DeFi be any different? Especially with one of the most corrupt Presidents in history sitting in office.

FYI I don’t lean to any political party; if you do, you’re allowing yourself to be part of their system of control. In Finance, and in life, it is MUCH better to be suspicious of ALL politicians, regardless of creed or party ties.

Winners vs. Victims:

Relative survivors: $BTC, $ETH, $TRX, $BNB.

TRX barely flinched (~10%) and defended its support.

BNB fell ~33%—bad, but less bad than peers.

Everything else: widespread -50% to -80%, with smalls/memes being pulled LITERALLY to zero. $PENGU was an extreme meme casualty and its Daily structure is destroyed. Price deeply underneath EMA stack.

Interpretation: In a liquidity crisis, capital flees to “blue chips” and stable ecosystems. The rest gets repriced fast.

CeFi vs DeFi: Who Broke, Who Breathed

CeFi (some majors): throttling, API hiccups, dashboards lagging. Panic worsened because traders couldn’t act.

DeFi rails (Aave/Uniswap/Hyperliquid): no downtime; smart contracts liquidated as designed. Painful? Yes. Operationally robust? Also yes.

Takeaway: The pipes worked on-chain—even if they transported carnage. My rule: if one alt looks bad, they all look bad. We had many looking bad.

Conclusion: The tariff didn’t create weakness; it accelerated it and synchronized the exit. Was it likely orchestrated / coordinated? High probability.

What I’d Tell a Friend Over Coffee:

Don’t try to buy insanity; buy the reclaim. Treat flashy wicks as liquidity events, not value unlocks. A whale with a signal (or a phone call) can move first. Your edge is process, not prediction.

Where We Go From Here

Bull case: This was a massive deleveraging event that “reset” the board; “shakeout before higher-highs.” BTC/ETH holding key long-term structure could support that view.

Bear case: Confidence damaged and lingers. Some sectors (Alts / Memes) won’t recover quickly. If macro (tariffs, policy) worsens, we could chop or bleed further.

My base case: Expect range and repair, not a V-reversal. Patience gets paid—and the second move (the reclaim) is safer than the first.

Final Word

Oct 10 wasn’t random. It was human decision → headline → leverage cascade, amplified by someone moving first. Markets will do that again, and again, and again.

We don’t need to catch the wick; we need to survive the flush and buy acceptance with defined risk. How do you do that? YOU DON’T PLAY WITH LEVERAGE.

Anyone following me for a while has heard me repeatedly explain this:

• You do not own ANYTHING on a USD marginated leverage contract.

• This means you are not “Invested” in said project.

• You are borrowing money from the CEX to gamble on price action.

• During liquidity events like this, you are first to be farmed.

Do you know who survived October 10th? SPOT INVESTORS. With the exception of maybe (up to) 4x BTC/USDT leverage traders. THAT’S IT.

This should tell you how important it is to focus your portfolio on Bitcoin, and if you dare venture into Alts, it should be long-term, macro based spot token holdings. If you don’t think a project can withstand 5-10 years, why would you buy it? Just to get rich quick? Believe me, after losing money through the COVID collapse, LUNA, FTX, and now “Tariff Tantrum,” this will not be the last time DeFi gets rugged in a single day.

Your portfolio survives when you custody tokens yourself, and when it’s not leveraged. As always; stay focused, and reduce your risk.

—DTS